Launch Your Free Zone Business in the UAE

Set up your company effortlessly with DocuBay. Enjoy 100% foreign ownership, tax advantages, and access to cutting-edge infrastructure in the UAE’s premier Free Zones.

Unlock Endless Opportunities

With a Free Zone Company

Establish your business in a UAE Free Zone and unlock a world of opportunities. Benefit from unmatched advantages such as tax exemptions, full foreign ownership, and access to world-class infrastructure. Free Zone companies are your gateway to lucrative regional and international markets. With DocuBay’s expertise, setting up your Free Zone business is seamless, stress-free, and tailored to your success.

100% Foreign Ownership

Tax Exemptions And Financial Benefits

Access To International And Regional Markets

Reliable and Secure Support from DocuBay

Effortless compliance with UAE regulations

Why the UAE is the Perfect Place to

Start Your Business

World-Class Infrastructure

Access modern facilities, ports, and logistics hubs tailored for global trade.

Tax Benefits

Maximize profits with low taxes and 0% personal tax.

Market Access

Tap into lucrative international and regional markets.

100% Repatriation of Profits

Freely transfer your earnings and capital abroad without restrictions.

Stable Economy

Operate in a region known for political and economic stability.

Innovation-Driven

Leverage government initiatives supporting startups and advanced industries.

Residency Benefits

Secure investor and employee visas with ease, offering long-term stability.

Cultural Diversity

Work in a cosmopolitan environment with global business professionals.

Startup Support

Access funding, resources, and programs tailored for entrepreneurs.

Skilled Talent Pool

Attract top talent with tax-free salaries and incentives.

Explore and choose from 40+ Free Zones across the UAE

From Innovation to Industry Excellence

Abu Dhabi Global Market (ADGM)

Financial free zone offering robust frameworks and global opportunities.

Dubai Airport Freezone Authority (DAFZA)

A premium free zone near Dubai Airport for logistics and trade.

Simplify Your Free Zone Setup

Establish your business in a UAE Free Zone with DocuBay’s streamlined, 5-step process.

- 1

Book a Consultation

Explore the best Free Zone options for your business goals.

- 2

Choose Structure & Activities

Select the rigth legal structure and business activities that suit your needs.

- 3

Submit Documents

We’ll manage document preparation and submissions

- 4

Get License & Visas

Secure your Free Zone trade license and investor visas.

- 5

Open Bank Account & Finalize Compliance

Set up your corporate bank account and ensure compliance

Do you need ⎯

some help?

We understand navigating legal and corporate processes can be complex. Let us guide you every step of the way to ensure a smooth, hassle-free experience.

Speak to an Expert

What is a Free Zone in the UAE?

A Free Zone in the UAE is a designated economic area designed to attract foreign investment. These zones offer:

- 100% foreign ownership

- Streamlined business setup processes

- Specialized infrastructure tailored to specific industries

- Access to global markets through strategic locations

While Free Zones provide many benefits, businesses operating in these zones must comply with UAE regulations, including Corporate Tax requirements as applicable.

What are the benefits of setting up a company in a Free Zone?

Setting up a Free Zone company in the UAE provides several advantages, including:

- 100% foreign ownership

- Simplified company setup and licensing processes

- Access to world-class infrastructure and skilled talent

- Full repatriation of capital and profits

- No currency restrictions

- Exemption from import and export duties (in certain zones)

Note: Free Zone companies are now subject to Corporate Tax at a rate of 9% on non-qualifying income, while qualifying income may be eligible for a 0% tax rate under specific conditions.

How long does it take to set up a Free Zone company?

The setup process for a Free Zone company typically takes 1 to 3 weeks, depending on:

- The chosen Free Zone authority

- Business activity

- Completeness of required documentation

DocuBay ensures a seamless experience, expediting the process on your behalf.

What documents are required for Free Zone company formation?

The documents required for Free Zone company setup may vary by zone and business type. Generally, the following are needed:

- Passport copies of shareholders and directors

- Proof of residential address (e.g., utility bill or tenancy contract)

- Business plan (if required by the Free Zone authority)

- Completed application form

- UAE visa copies (if applicable)

DocuBay provides a tailored checklist to ensure all documents are accurately prepared and compliant.

Can I open a bank account for a Free Zone company?

Yes, Free Zone companies can open corporate bank accounts in the UAE. DocuBay assists with:

- Recommending suitable banking partners

- Ensuring compliance with bank requirements

- Supporting you in document preparation and submission

Our expertise ensures a smooth and efficient account opening process.

How can DocuBay assist with Free Zone company setup?

DocuBay provides end-to-end support for Free Zone company formation, including:

- Selecting the best Free Zone based on your business objectives

- Preparing and submitting all required documentation

- Liaising with Free Zone authorities for licensing and approvals

- Assisting with Corporate Tax registration and compliance

- Providing ongoing support for visas, licensing, and other legal services

With DocuBay, your Free Zone company setup becomes hassle-free and efficient.

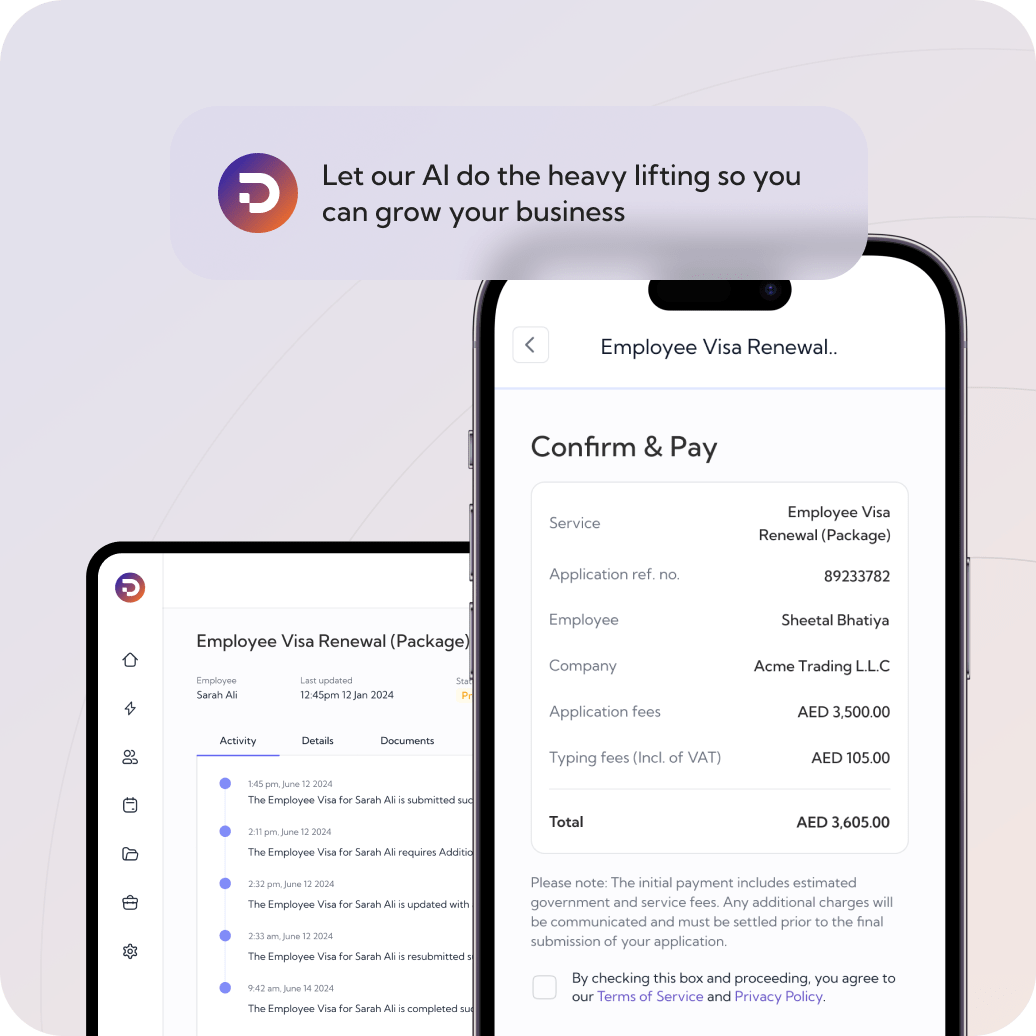

Why Choose DocuBay: Simplify, Streamline, and Succeed in the UAE

All-in-One Platform for Business Services

DocuBay brings every critical workflow into one secure dashboard—from licence-lifecycle management to specialist legal support—so you can run and scale your business with confidence.

Licence-Lifecycle Management with guided workflows.

Employment & Residency (Manage labour contracts, MOHRE category, and much more.)

Permits & Approvals (secure NOCs and clearances without bottlenecks.)

Legal & Corporate Services (contracts, attestations, translations, tax advisory, and more.)

Entity Management (add new licences or activities as your organisation grows.)

Robust Compliance & Risk Management

Our AI-powered engine keeps you audit-ready by catching issues early, monitoring regulatory changes, and delivering real‑time risk insights.

AI Pre-Validation (verify applications against live requirements before submission.)

Integrated KYC & Background Checks (screen partners and stakeholders in seconds.)

Risk Dashboard (instant alerts for upcoming filings, expiries, and compliance gaps.)

Centralised Document Vault (secure storage with version control and role-based access.)

Smart Reminders & Regulatory Tracking (never miss a deadline or policy update.)

Expert Guidance & Support

Lean on a team that understands UAE regulations inside out—backed by 24/7 assistance and rich learning resources.

On-Demand Legal & Compliance Consultation

Dedicated Account Manager (Tailored business support)

Dedicated Account Managers

Knowledge Portal (step-by-step guides, FAQs, and best-practice templates.)

Webinars & Training Sessions (stay ahead of new legislation and industry trends.)

24/7 Live Chat & Email Support. immediate help, day or night.

What Our Clients Say

Ready to launch Your UAE Company with Ease?

Schedule a free consultation to discover how DocuBay can simplify your company formation process. Let us handle the setup while you focus on success in the UAE’s thriving market.

* Prices and services are subject to change. ** Timeframes are estimates and may vary. For full details, please review our Terms of Service.

This website is solely owned by DocuBay (Sygneo Systems FZCO) and is not affiliated by any government owned/based authority.

Company

Legal & Compliance Services

Popular Services

© 2025 DocuBay (Sygneo Systems FZCO), All rights reserved. Terms of Service,Privacy Policy,Refund Policy

Powered by Sygneo

.svg)

.svg)

.svg)

.svg)