Tax Advisory, Auditing & Filing

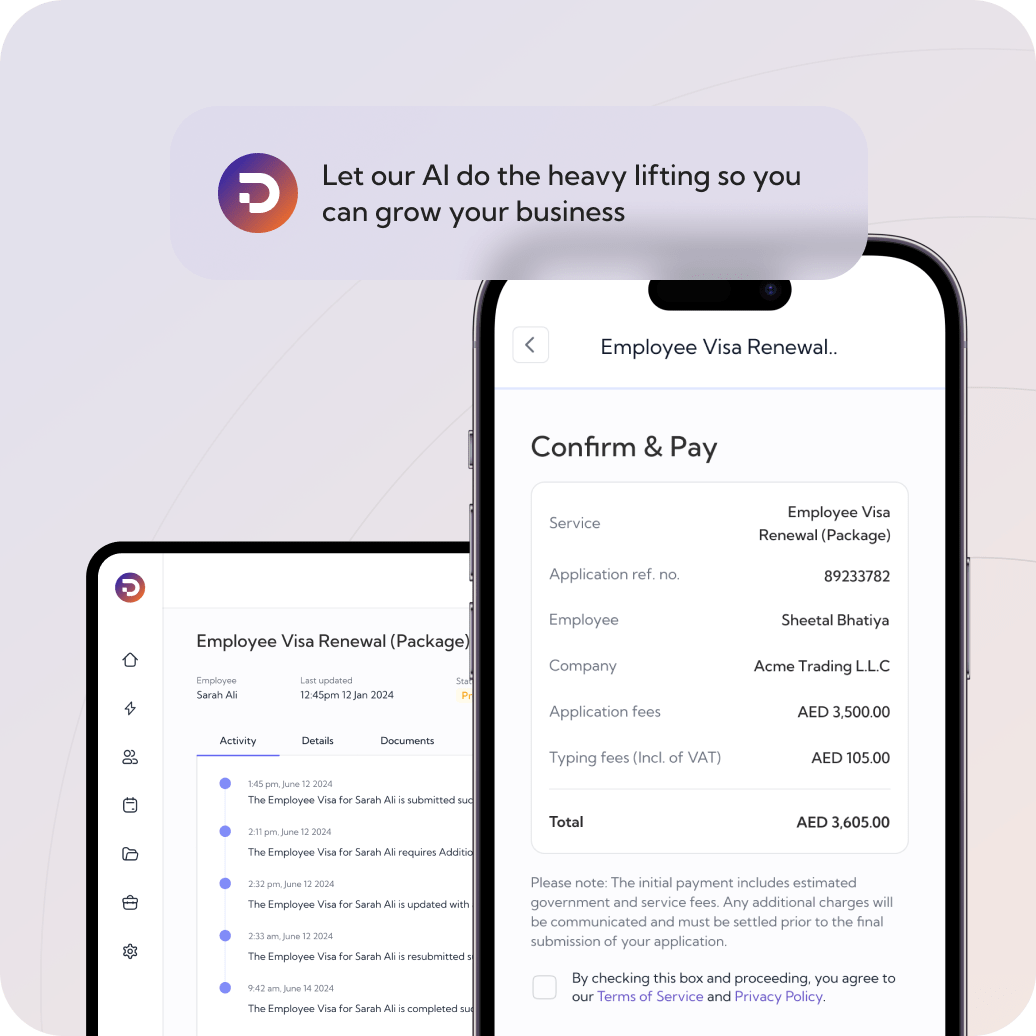

DocuBay delivers an integrated approach to tax, audit, and corporate structuring. Our platform combines expert insight with AI checks to keep every filing accurate, timely, and aligned with UAE regulations so you can focus on growth.

Simplify Complex Tax Tasks

Managing VAT returns, corporate tax, and audit readiness can consume valuable resources. Missed deadlines or data gaps may trigger penalties and damage credibility. DocuBay brings every requirement into one dashboard, applies automated validity checks, and assigns clear next steps to your team. You see what is due, upload the right files, and track authority responses in real time.

Our Comprehensive Tax, Auditing & Filing Services

Below are the key services we offer, each with a concise description outlining its purpose and value.

Business Valuation

Our valuation experts provide an objective assessment of your company’s worth, taking into account assets, liabilities, and market trends. This service supports strategic decision-making for mergers, acquisitions, financing, or shareholder exits, ensuring transparent transactions and investor confidence.

Corporate Structuring & Restructuring

We analyze your existing corporate framework and propose optimized structures for better efficiency and tax benefits. Whether you’re expanding internationally or merging departments, our service ensures smooth transitions, mitigates risks, and aligns your legal and financial setups with long-term objectives.

Internal Auditing

Our internal audit services evaluate your company’s governance, risk management, and internal controls. By reviewing operational processes and pinpointing inefficiencies, we help reinforce compliance, reduce fraud potential, and enhance overall operational transparency across departments.

Compliance Auditing

Compliance Auditing targets adherence to industry and regulatory standards, verifying your organization’s processes align with legal obligations. This service identifies non-compliance risks, addresses any gaps, and preserves your reputation by maintaining the highest ethical and legal benchmarks.

VAT Filing

Stay on top of evolving VAT regulations and avoid penalties with our end-to-end VAT filing service. We handle data collection, calculation, and submission, ensuring deadlines are met and records are meticulously maintained for potential audits or government inquiries.

Corporate Tax Filing

Our team expertly navigates the UAE’s corporate tax environment, preparing and submitting your tax returns accurately and on time. We focus on compliance while identifying any opportunities for deductions or credits, aiming to optimize your tax liability without compromising legal requirements.

Corporate Tax Impact

We offer in-depth assessments on how changing tax regulations or expansions into new markets might affect your fiscal health. From modeling different scenarios to suggesting compliance strategies, we ensure you’re prepared for tax implications and can make proactive business decisions.

Get Started with DocuBay

Choose Your Plan

What's included:

Up to 20 Employees

Unlimited Service Access

Smart AI pre-submission checks

Core Reminders

Secure Document Vault

Application Tracking

Invite Team Members & Role Management

Live Chat & Knowledgebase Access

What's included:

Includes everything in Essential, Plus:

Up to 50 Employees

Multiple Business Licenses

Compliance Management Suite

Integrated digital KYC

Due Diligence & Background Screening

Health Insurance Module

Advanced Analytics & Reporting

What's included:

Includes everything in Premium, Plus:

Dedicated Account Manager

License Management Module

Visa Quota Allocation

Application Fee Discounts

Permits & Approvals

Custom Integrations (HRMS/ERP)

24/7 Support (SLA Backed)

Do you need ⎯

some help?

We understand navigating legal and corporate processes can be complex. Let us guide you every step of the way to ensure a smooth, hassle-free experience.

Speak to an Expert

Is a business valuation useful for small or medium companies?

Yes. Accurate valuations support stronger funding pitches, partnership talks, and strategic planning. DocuBay applies market‑led methods and delivers a clear report accepted by banks and investors.

When should I explore corporate restructuring?

Consider restructuring during expansion, mergers, acquisitions, or major pivots. Our specialists review your goals and recommend setups that enhance efficiency and limit risk.

Are internal and compliance audits mandatory for every firm?

Some sectors require annual audits by law, but voluntary reviews help reveal process gaps and boost stakeholder confidence. DocuBay’s audit module keeps findings and action items in one place.

How often must VAT returns be filed in the UAE?

Most companies file quarterly, though some report monthly. DocuBay schedules each period, checks data for inconsistencies, and submits on time to avoid penalties.

What if my business operates in several countries with different tax rules?

The platform maps multi‑jurisdiction obligations, flags potential double‑tax exposures, and coordinates filings through trusted partners, ensuring you meet every requirement without duplication.

Why Choose DocuBay: Simplify, Streamline, and Succeed in the UAE

All-in-One Platform for Business Services

DocuBay brings every critical workflow into one secure dashboard—from licence-lifecycle management to specialist legal support—so you can run and scale your business with confidence.

Licence-Lifecycle Management with guided workflows.

Employment & Residency (Manage labour contracts, MOHRE category, and much more.)

Permits & Approvals (secure NOCs and clearances without bottlenecks.)

Legal & Corporate Services (contracts, attestations, translations, tax advisory, and more.)

Entity Management (add new licences or activities as your organisation grows.)

Robust Compliance & Risk Management

Our AI-powered engine keeps you audit-ready by catching issues early, monitoring regulatory changes, and delivering real‑time risk insights.

AI Pre-Validation (verify applications against live requirements before submission.)

Integrated KYC & Background Checks (screen partners and stakeholders in seconds.)

Risk Dashboard (instant alerts for upcoming filings, expiries, and compliance gaps.)

Centralised Document Vault (secure storage with version control and role-based access.)

Smart Reminders & Regulatory Tracking (never miss a deadline or policy update.)

Expert Guidance & Support

Lean on a team that understands UAE regulations inside out—backed by 24/7 assistance and rich learning resources.

On-Demand Legal & Compliance Consultation

Dedicated Account Manager (Tailored business support)

Dedicated Account Managers

Knowledge Portal (step-by-step guides, FAQs, and best-practice templates.)

Webinars & Training Sessions (stay ahead of new legislation and industry trends.)

24/7 Live Chat & Email Support. immediate help, day or night.

What Our Clients Say

Need Expert Tax Support for Your Business?

Let DocuBay handle tax advisory, auditing, and filing services to ensure compliance and reduce your business tax burden effectively.

* Prices and services are subject to change. ** Timeframes are estimates and may vary. For full details, please review our Terms of Service.

This website is solely owned by DocuBay (Sygneo Systems FZCO) and is not affiliated by any government owned/based authority.

Company

Legal & Compliance Services

Popular Services

© 2025 DocuBay (Sygneo Systems FZCO), All rights reserved. Terms of Service,Privacy Policy,Refund Policy

Powered by Sygneo

.svg)

.svg)

.svg)

.svg)